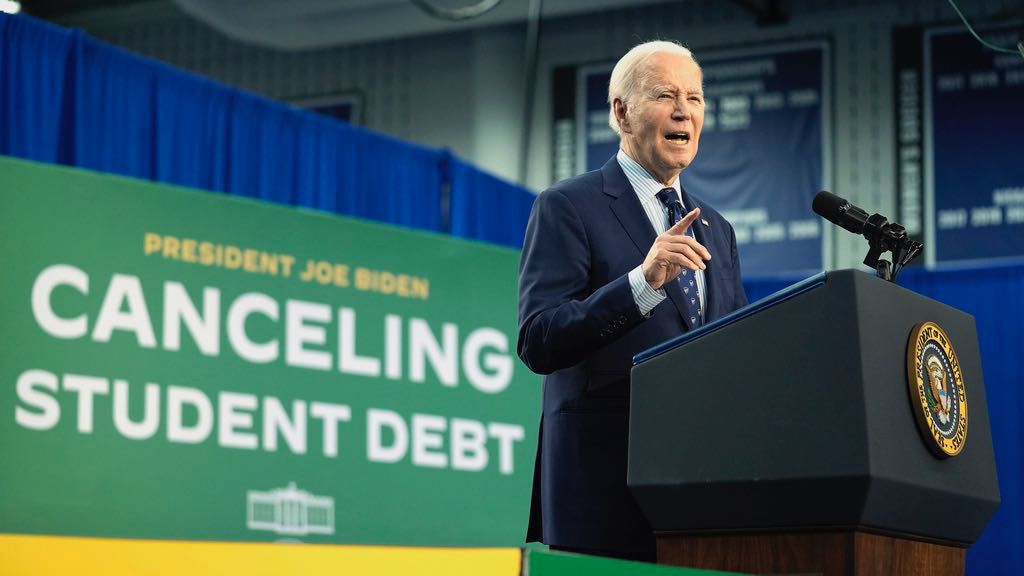

More than 277,000 Americans will have their federally backed student loan debt canceled, a total of $7.4 billion of relief, in the latest round of debt forgiveness announced Friday by the White House.

With this latest announcement, the Biden administration will have relieved 4.3 million Americans of their debt at a total of $153 billion — roughly 10% of all Americans with student loan debt.

This move comes hot on the heels of President Joe Biden’s announcement Monday, in which he outlined plans to provide student debt relief to more than 25 million Americans.

"During his trip to Madison, [Wisconsin], the president met with borrowers who have gotten their debt canceled under his administration," White House press secretary Karine Jean-Pierre told reporters Thursday. "They told him how impactful that relief has been, allowing them to buy homes, start businesses and much more. President Biden knows that these stories are not unique to Madison. He hears stories like this all across the country. That's why our administration is working as quickly as possible to be ready once the proposed rules are finalized to start implementing some of them as early as this fall."

This round of relief goes to Americans enrolled in the federal SAVE Plan, an income-driven repayment plan designed to lower payments for borrowers. It also offers relief for those in other income-driven repayment plans, as well as borrowers receiving relief under Public Service Loan Forgiveness plans.

Nearly 900,000 public service workers have had their student debt canceled, as well as 1.3 million borrowers covered by court settlements related to unethical practices by their schools and nearly 550,000 borrowers with a total and permanent disability, including many veterans.

"This is historic — more than any other administration in history — and it really shows the commitment that we have to ongoing change as we fix this broken system," Education Secretary Miguel Cardona told reporters.

The effort is not without detractors, though. Republican attorneys general in 18 states have filed lawsuits to block various parts of Biden’s plans, including challenges to the SAVE Plan.

“Yet again, the president is unilaterally trying to impose an extraordinarily expensive and controversial policy that he could not get through Congress,” according to the new suit led by Missouri Attorney General Andrew Bailey.

"From day one of my administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity," Biden said in a statement. "I will never stop working to cancel student debt — no matter how many times Republican elected officials try to stop us."

A senior administration official expanded on the president’s statement, arguing that the statutes the federal government is operating under will hold firm — and that, if the legal challenges succeeded, millions of borrowers would face paying hundreds of dollars more in monthly payments and losing access to income-based loan forgiveness and income-contingent repayment plans.

"It’s an attack without merit or law and it’s an attempt to take away relief that people deserve," the senior official said.

An analysis of the loan forgiveness plan by the Penn Wharton Budget Model estimated that the Biden administration’s loan forgiveness announcement, added to a previous estimate made for the SAVE Plan, would cost taxpayers $559 billion. A Department of Education estimate published in the Federal Register in January suggests a net cost of about $138 billion through 2032. (A Congressional Budget Office estimate puts the cost of the program at about $230 billion through 2033.)

A senior administration official, when asked if they feel the Penn Wharton estimate is an effective use of tax dollars, said they believe the program "is providing critical breathing room for borrowers."

Alongside Friday’s announcement, the White House released information on student debt cancellation for all 50 states, Washington, D.C., and Puerto Rico. Texas (25,800 people receiving relief), California (23,170), Florida (21,280), New York (13,150) and Ohio (11,840) have the most residents benefitting from debt relief in this most recent round of relief.