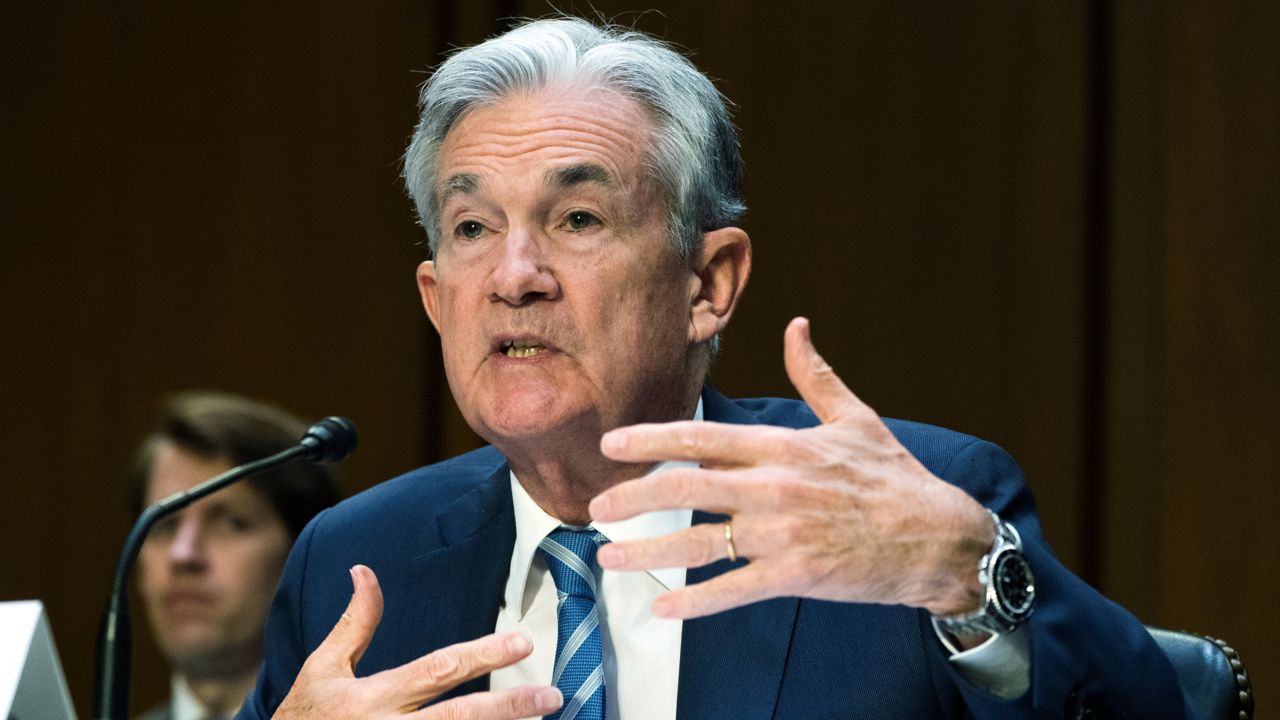

Federal Reserve Chairman Jerome Powell braced lawmakers Wednesday for even higher interest rates as he discussed the balancing act the central bank faces in trying to bring down inflation without triggering a recession.

What You Need To Know

- Federal Reserve Chairman Jerome Powell braced lawmakers Wednesday for even higher interest rates as he discussed the balancing act the central bank faces in trying to bring down inflation without triggering a recession

- Last week, the Fed raised its benchmark interest rate by three-quarters of a percentage point, its largest hike in 28 years

- Testifying before the Senate Banking, Housing and Urban Affairs Committee, Powell said the Fed anticipates additional rate increases, adding the bank’s Board of Governors will “make our decisions meeting by meeting"

- Senators from both parties argued raising interest rates won’t address the biggest drivers of soaring prices — gas, food and housing costs — and could potentially damage the economy further

Last week, the Fed raised its benchmark interest rate by three-quarters of a percentage point, its largest hike in 28 years. The move brought the interest rate up to a range of 1.5% to 1.75%.

Testifying before the Senate Banking, Housing and Urban Affairs Committee, Powell said the Fed anticipates additional rate increases, adding the bank’s Board of Governors will “make our decisions meeting by meeting.”

“I think what you will see is … expeditious progress toward higher rates,” Powell testified, suggesting the interest rate could climb between 3% and 3.5% before the end of the year.

Consumer prices were up 8.6% in May compared to a year earlier, a four-decade high for inflation, according to the Labor Department.

Senators from both parties, however, argued raising interest rates won’t address the biggest drivers of soaring prices — gas, food and housing costs — and could potentially damage the economy further.

Sen. Elizabeth Warren, D-Mass., asked Powell to reconsider higher interest rate hikes because she said they could cause businesses to lay off employees and make it more difficult for Americans to receive home loans.

“Inflation is like an illness, and medicine needs to be tailored to the specific problem, otherwise you could make things a lot worse,” Warren said. “And right now, the Fed has no control over the main drivers of rising prices.”

Sen. Mike Rounds, R-S.D., also asked Powell if the rate hikes run the risk of backfiring.

“Clearly you are aware that you're going to be the person that takes the fall if inflation is not brought under control and this administration is going to point to you and to the Federal Reserve, saying you have the tools to fix inflation and you're not doing your job,” Rounds said.

Powell, who was sworn in last month for his second term leading the central bank, acknowledged the higher interest rates won’t impact gas and food costs and said there is a danger that raising rates too high or too quickly could spur a recession. But he said the Fed’s tools can “affect certain aspects of inflation.”

He reiterated the Fed’s goal is to achieve maximum employment and price stability. He called the U.S. labor market “unsustainably hot” and said the Fed is working to “restore price stability to put the economy back in a place where in the medium and longer term we can have a sustained period of what we would call maximum employment.”

Powell said recent indicators show growth slowing, which should help better balance supply and demand. But he acknowledged economic conditions worldwide remain uncertain and there could be more surprises ahead.

Republicans and Democrats, meanwhile, sought to cast blame for the record inflation.

GOP lawmakers pointed the finger at the Biden administration and Democrats for ignoring their warnings about inflation in 2021, pushing policies to wean Americans off oil and passing the $1.9 trillion COVID-19 relief package last year.

“The Biden administration and congressional Democrats still somehow considered it responsible to ram through a partisan $1.9 trillion spending spree,” Sen. Thom Tillis, R-N.C., said. “It is little wonder how this catalyzed inflation we see today.”

Democrats, meanwhile, noted that inflation is happening globally and blamed issues such as the Russia-Ukraine war and lockdowns. They also accused corporate executives, including oil CEOs, of raising prices.

“There is no invisible hand of the market,” said Rep. Sherrod Brown, D-Ohio, the committee’s chairman. “When prices go up, it's because someone made a choice to raise them in corporate boardrooms when the supply chain slowed down or input costs go up or resources become scarce.”

Brown said executives could scale back bonuses and stock buybacks, forego raises and settle for lesser profits, but are instead choosing to raise prices on customers.