The CEO of one of Canada’s largest supermarket companies said sales of American products at its stores are “rapidly dropping” while discussing the potential impact of the emerging trade war between the two North American neighbors.

“American products we are selling as a percentage of our total sales are rapidly dropping,” Empire Company Ltd. President and CEO Michael Medline said on a fiscal earnings call Thursday. “We have heard loud and clear from our customers that they want Canadian products.”

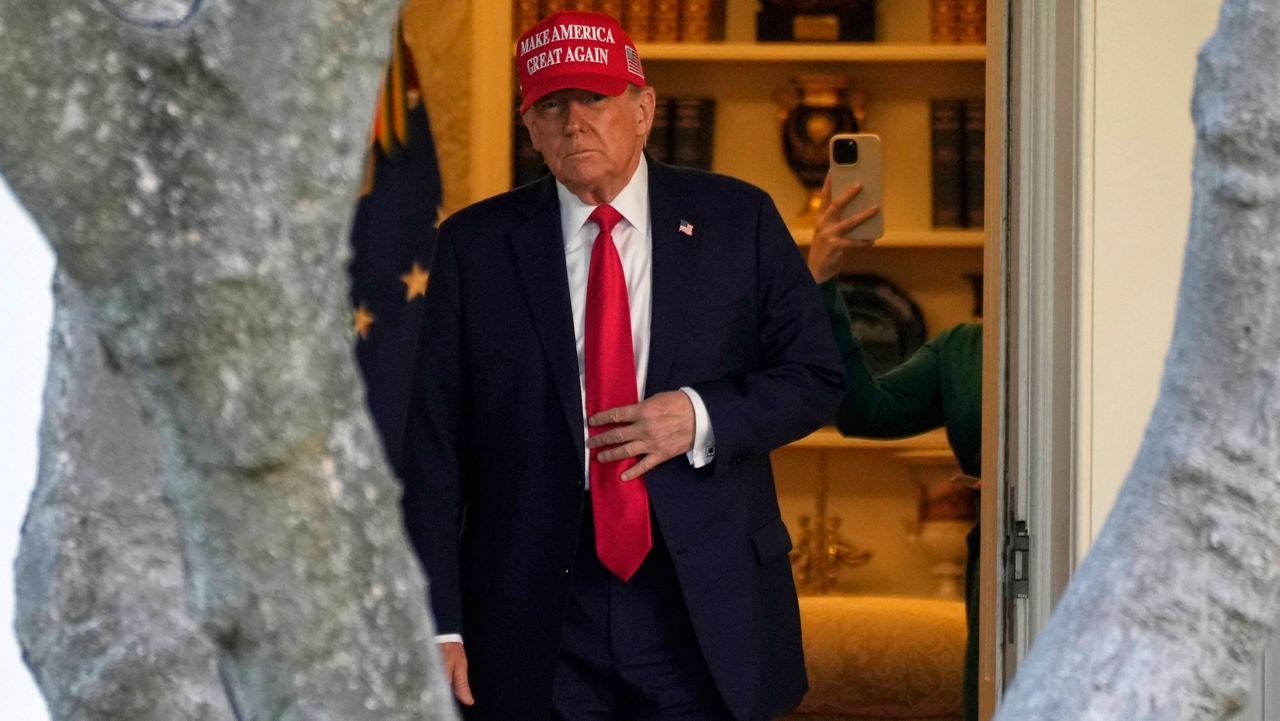

The comment came while the Empire Company Ltd. head was discussing the potential impact of tariffs President Donald Trump has made a key part of his trade agenda, with Medline calling them a “real threat to the Canadian economy.”

“Since we spoke to you in December, there has been a significant rise in unpredictability in our operating environment with the political shifts in the U.S. and tariffs, and it is unclear how this will play out over the next several years,” Medline said.

Medline said that while the 12% average of products coming from the U.S. is on the decline and the top grocer has developed “good alternatives” in general to address natural disasters or shortages in any particular region, the retaliatory tariffs Trump will place on major trading partners next month have the potential for the most indirect impact.

“Our most challenging category to mitigate the threat of retaliatory tariffs is produce where in Canada, in the winter, we do not always have viable alternatives,” he said.

Medline added that some of Empire's suppliers in particular are directly affected and that his company, which owns major Canadian chains such as Sobeys, does not have to pass price increases onto consumers.

“Our supplier partners with U.S.-based production are directly impacted by retaliatory tariffs,” he said. “This puts pressure on them. And as a result, they may be looking to pass these increased costs on.”

Medline's comments come as the two nations have been entangled in a series of on-again, off-again tariffs after Trump’s opening bid in the saga, which was a 25% fee on imports from Canada that he said were meant to pressure the country to address the influx of fentanyl coming across the border into the U.S. Two days after imposing the duties, Trump hedged on a significant portion.

This week, U.S. Commerce Secretary Howard Lutnick and the premier of Ontario, Doug Ford, met in Washington to discuss another set of tariff threats that both sides then pulled back on at the last minute.

Ford on Thursday called it an “extremely productive” meeting and said the pair agreed to hold another one next week.

Secretary of State Marco Rubio is also in Canada this week for meetings with top foreign policy leaders from the Group of Seven countries.

Despite the turbulent approach to the fees thus far rattling U.S. markets, Trump has insisted they are necessary, making the case the U.S. economy is going through a “period of transition.”

His most far-reaching plan in his broader tariff and trade agenda placing reciprocal tariffs on major U.S. trading partners — intended to balance trade deficits and, as Trump says, bring in revenue to America — is set to take effect on April 2, with the U.S. president telling reporters on Thursday that he is “not going to bend at all.”