A federal appeals court halted a program that lowered monthly payments for student borrowers based on income, marking the latest blow the Biden administration has suffered in its efforts to take on debt from higher education and leaving millions enrolled in the plan in limbo.

The Eighth Circuit Court of Appeals on Thursday granted a motion for an administrative stay from Republican-led states seeking to block the Biden administration’s Saving on a Valuable Education or SAVE plan. The ruling means the entirety of the program is now on hold as the legal process continues.

In a statement, Education Secretary Miguel Cardona said borrowers enrolled in the program will be placed “in an interest-free forbearance” while the administration fights the legal challenges. He added the Department of Education will provide updates to those enrolled and impacted by the ruling in the “coming days.”

“Today’s ruling from the Eighth Circuit blocking President Biden’s SAVE plan could have devastating consequences for millions of student loan borrowers crushed by unaffordable monthly payments if it remains in effect,” Cardona said in the statement. “It’s shameful that politically motivated lawsuits waged by Republican elected officials are once again standing in the way of lower payments for millions of borrowers.”

Meanwhile, in a post on X, formerly Twitter, Missouri Attorney General Andrew Bailey called the decision a “HUGE win.”

Thursday’s decision follows a ruling last month by federal judges in Kansas and Missouri that blocked parts of the plan. A subsequent ruling, however, from the 10th U.S. Circuit Court of Appeals allowed the administration to move forward with implementation of the program as the case continued making its way through courts. The entire SAVE plan is now on hold after Thursday’s decision.

The repayment plan lowers monthly payments for borrowers based on income, halts loans from growing due to unpaid interest and lessens requirements for low-balance borrowers to receive forgiveness. The administration intended to lower monthly payments from 10% of a person’s discretionary income to 5% for undergraduate loans through the program starting this month.

The SAVE plan was finalized in the wake of the Supreme Court’s decision more than a year ago to strike down Biden’s plan to cancel $10,000 in student loans for those making less than $125,000 a year and up to $20,000 for Pell Grant recipients, with the court arguing the president overstepped the White House’s constitutional authority.

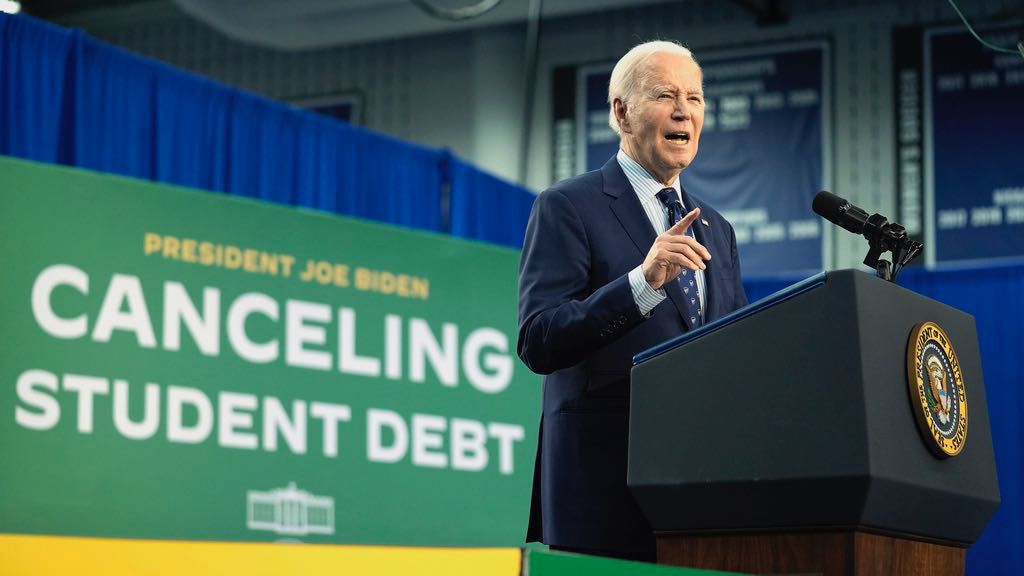

In the face of a series of legal setbacks in his efforts to address student debt, President Joe Biden has touted the loans he has been able forgive through other avenues, including fixes to existing programs.

On Thursday, the administration announced Biden was canceling another $1.2 billion in student debt for 35,000 teachers, nurses, firefighters and other public service employees through fixes to the Public Service Loan Forgiveness Program.

The latest round of forgiveness brings the total amount of student loan relief under Biden to $168.5 billion for 4.76 million Americans, the White House said.