The Department of Education on Wednesday announced it canceled an additional nearly $5 billion in federal student loans impacting more than 80,000 borrowers, marking the Biden administration’s latest effort to chip away at student debt.

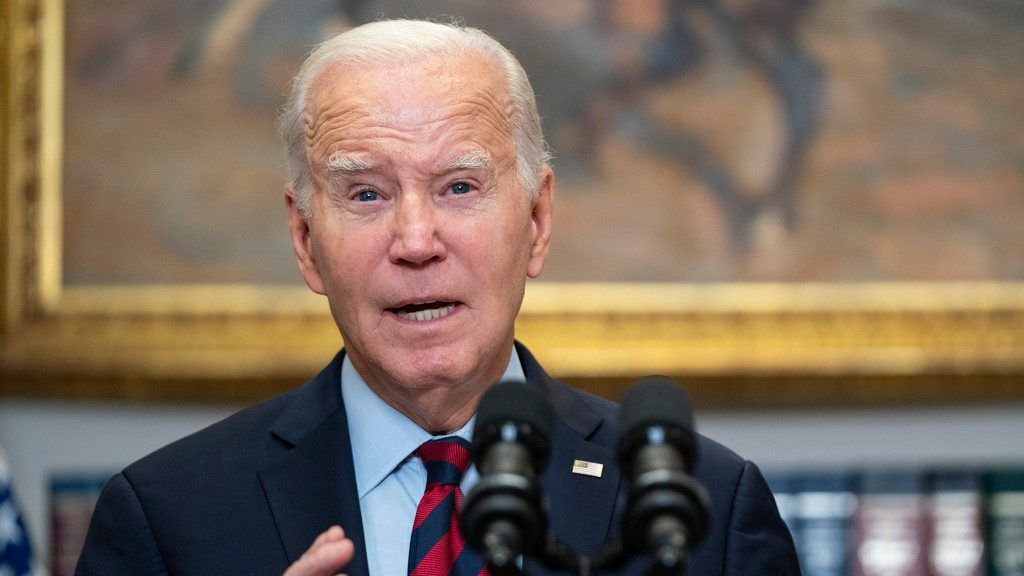

The latest cancellation brings the total amount of student debt wiped away under President Joe Biden to $132 billion for more than 3.6 million borrowers.

“This level of debt relief is unparalleled and we have no intention of slowing down,” Education Secretary Miguel Cardona said in a press release.

Wednesday’s loan relief comes through fixes to two existing programs: income-driven repayment forgiveness and public service loan forgiveness, which has become the approach the administration has relied upon to chip away at debt since the Supreme Court struck down Biden’s broader student loan forgiveness plan in June.

Under this method, the cancellations have applied to specific categories of borrowers such as public service workers, some of those who have been repaying loans for at least 20 years, certain people with a disability and borrowers who have been defrauded by schools.

This fall marked the first time borrowers had to start paying student loans again after a three-year pause as a result of the pandemic. Following the high court’s decision on Biden’s initial plan to cancel up to $20,000 for each borrower making less than a certain income, the president announced a 12-month “on-ramp” period in which borrowers will not receive harsh financial penalties, such as being reported to credit bureaus or debt collection agencies, if they miss a payment.

The Biden administration also announced a new repayment plan – called the Saving on a Valuable Education or SAVE plan – which lowers monthly payments for borrowers based on income, halts loans from growing due to unpaid interest and lessens requirements for low-balance borrowers to receive forgiveness.

As of early November, nearly 5.5 million people enrolled in the program two months after its launch, according to the White House.

Following the Supreme Court’s ruling, Biden also said he wasn’t giving up on more sweeping debt forgiveness, saying his administration would try its hand at forgiving debt under a new authority called the Higher Education Act of 1965 – something he warned would take a long time to finalize.

This fall, however, the Education Department released draft rules showing the administration is moving forward with a plan that was less broad than the one the Supreme Court struck down.