Between now and the start of primary voting in June, NY1 will take a closer look at the key issues in the race for mayor.

This week’s topic is housing, because no matter what kind of New Yorker you are, we all need a place to live.

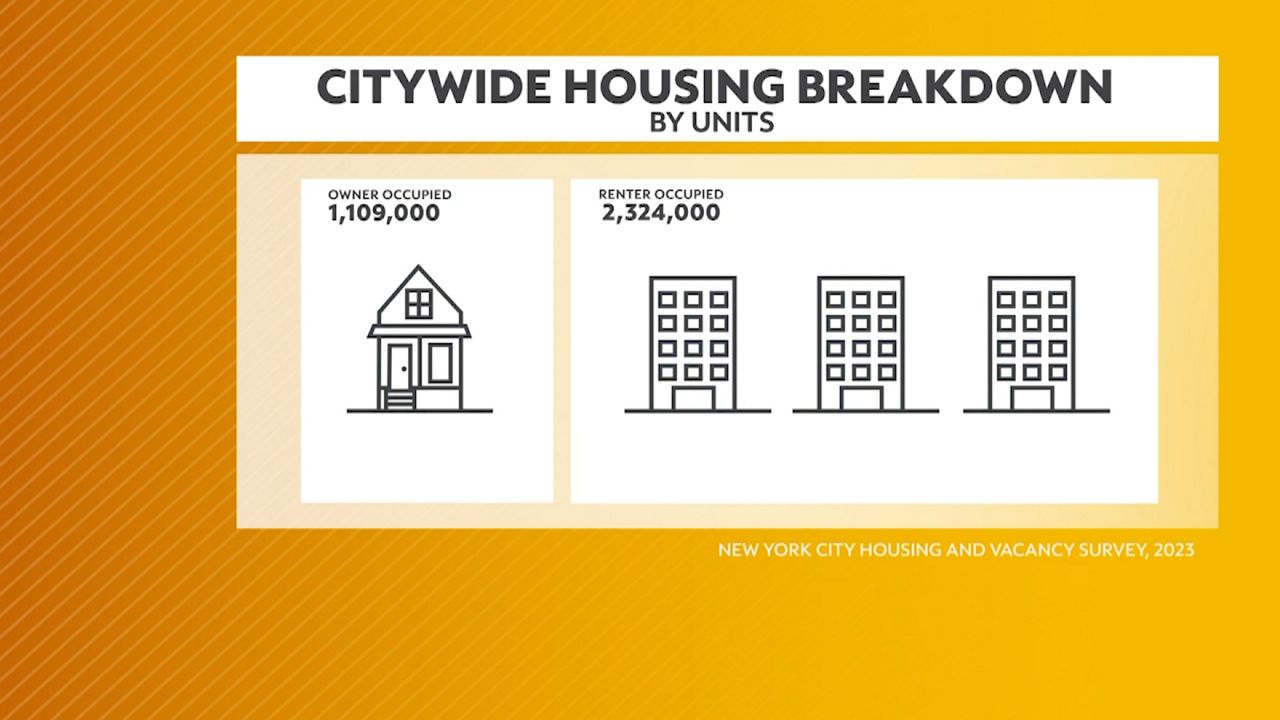

There are about 3.5 million housing units in the city.

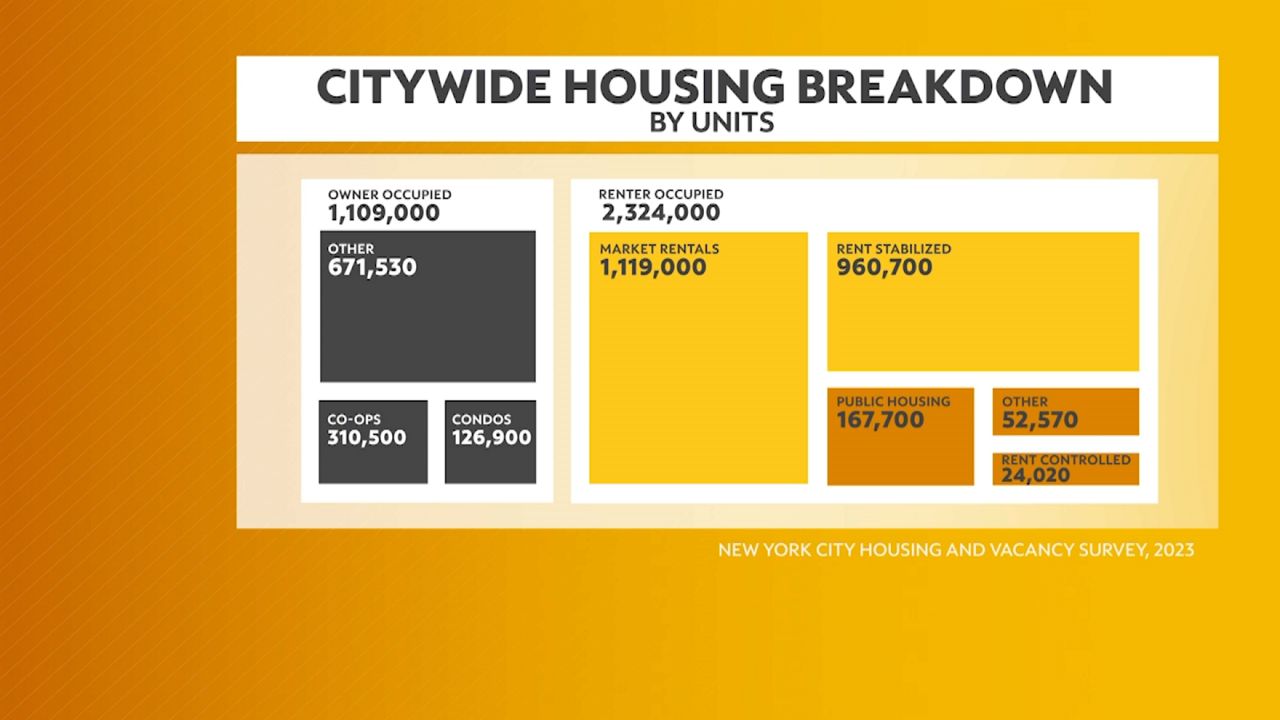

Around 1 million homes are owner-occupied, while the remaining 2.3 million are renter-occupied.

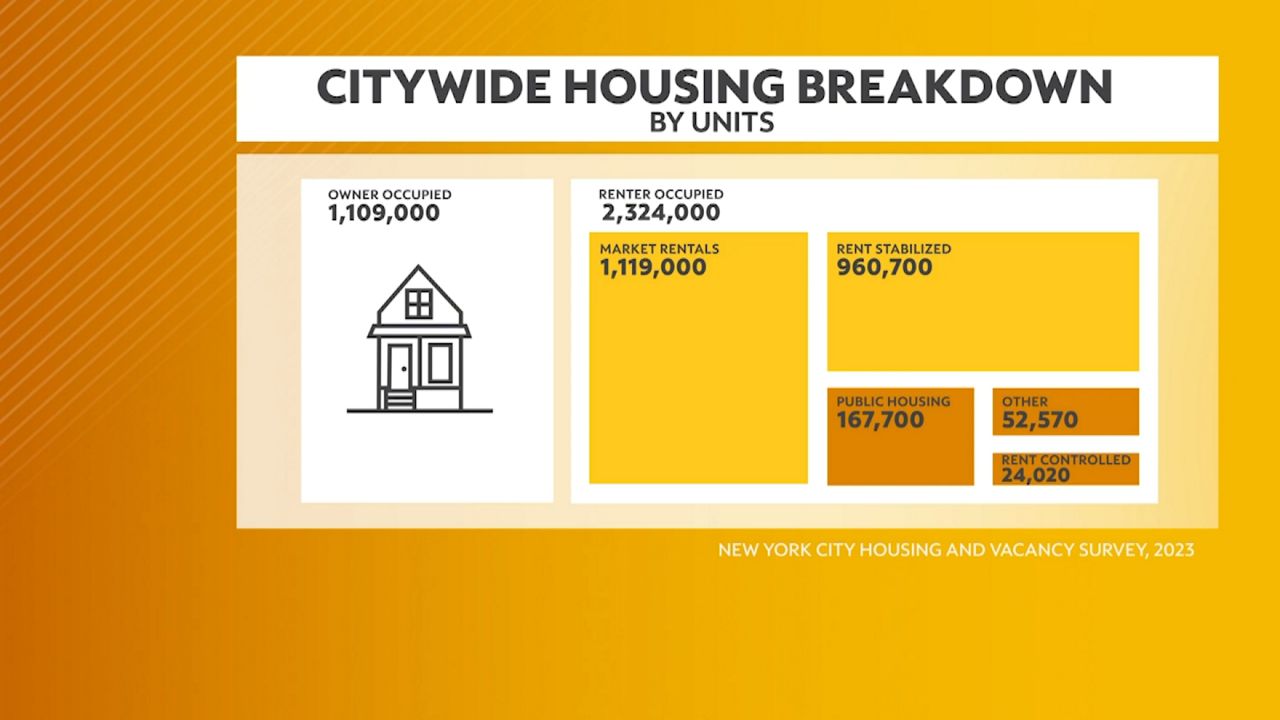

Looking at the rental market first: about half the units are rented at market rate, meaning landlords can charge whatever they want. Slightly fewer than 1 million units are rent-stabilized, with limits on how much rents can increase.

The mayor has the most control over rent stabilized units as the mayor appoints members of the Rent Guidelines Board, which sets the annual increase.

Rounding out the rental side: 167,000 units of public housing and about 24,000 units still under rent control. These rent-controlled units are passed down from generation to generation, with extremely low rents for those lucky enough to hold on to them.

Meanwhile, owner-occupied housing—including hundreds of thousands of co-op units, condos and a large “other” category, mainly consisting of single-family homes—has its own unique interests and priorities.

Each of these groups and subgroups will be looking at the candidates for mayor and asking, “What are you doing for me?”

Crain’s New York reporter Nick Garber recently spoke with NY1, saying housing will play a key role in the mayoral race.

"There’s a lot of talk from all the candidates about the need to build more housing to bring down rents or at least stabilize them. There’s some division among the candidates on how to handle rent-stabilized housing,” he said. "There’s some debate about whether rents should be frozen by the Rent Guidelines Board—something the mayor controls—or whether they should continue to increase so landlords have the money to pay for renovations."

If you’re paying market-rate rent, costs are rising.

According to StreetEasy, the median asking rent for a one-bedroom apartment in Manhattan was $4,400 a month in February. It was $3,400 in Brooklyn, $3,000 in Queens and about $2,700 in both the Bronx and Staten Island.

Maybe you’d rather stop renting and start paying a mortgage.

In Manhattan, the median asking price for a home is now $1.5 million. In Brooklyn, it’s $1.1 million.

Candidates frequently talk about affordable housing. Most experts say high housing costs come down to supply and demand.

The orange bar on this graph represents the number of jobs in the city, while the blue bar represents the number of housing units.

The number of housing units has grown by only a few hundred thousand since 2010, while the number of jobs has increased by nearly 1 million.

That means more people competing for housing. As a result, some residents choose to leave.

According to an analysis from the Citizens Budget Commission, the high cost of housing contributes to out-migration from the city. When they leave, they pay taxes elsewhere, which ultimately reduces the city’s representation in Washington.

We’ll continue our issue-by-issue review of the election in the weeks ahead.