Never mind the big box stores or the national chains. In New York City, 98 percent of all businesses are small, with fewer than 100 employees. 89 percent are very small, employing fewer than 20 people.

"Small businesses are the economic engine of the U.S. and of the city of New York, period," said Gregg Bishop, commissioner of the New York City Department of Small Business Services.

- LIVE UPDATES: Coronavirus in New York City

- LIVES LOST: Remembering Victims of the Coronavirus

- What to Do If You Test Positive for COVID-19

- CDC Coronavirus Page

- WHO Coronavirus Page

You just have to look at the growing number of empty storefronts in the city to know that surviving and, more than that, thriving has never been simple for small businesses in New York City.

Soaring rents, high taxes, a long list of often confusing regulations and the $15 minimum wage meant many of them were already struggling. Along comes the coronavirus pandemic, which brings stay-at-home orders and the shuttering of all but essential businesses, creating a perfect storm that could close those businesses for good.

"We can all agree that our commercial corridors will never be what they were," said City Councilman Mark Gjonaj, who is the chair of the council's Committee on Small Business. "That was the writing on the wall before the pandemic broke. It was a changing landscape. But the pandemic might be the final nail for a lot of our businesses."

Bishop says the city, state and federal governments can't allow that to happen.

"The statistics say that 40 percent of small businesses could fail," he said. "As a city, we cannot allow that to be factual, because they employ nearly 3 million New Yorkers, and nearly 1.5 million will be out of work."

With the passage of the Coronavirus Aid, Relief and Economic Security, or CARES Act, Congress took the first step. The Paycheck Protection Program allows businesses to borrow money to cover their payroll for eight weeks. As long as they retain their employees, that loan becomes a grant. There are also a series of low-interest loans and grants available to help keep small businesses afloat.

Gjonaj, though, says it is only the beginning.

"I don't believe $350 billion, which is a lot of money, is going to be enough," he said. "We'll need other stimulus packages to help businesses open their doors. But we know a lot won't ever open their doors again."

By all accounts, the program, which rolled out on April 3, got off to a rocky start. A rush by business owners to complete their online applications overwhelmed banks. Several banks limited the businesses they lent to to existing customers, a policy that banks blamed on federal rules meant to catch terrorists and money launderers. One of the country's largest lenders, Wells Fargo, closed its online portal after only two days, saying it had maxed out its $10 billion target. (The Federal Reserve announced Wednesday that it is easing growth restrictions on Wells Fargo in an effort to allow the company to lend more aggressively to small businesses.)

Gjonaj says loans are not really the answer, especially for "microbusinesses," those mom and pop operations that have been neighborhood mainstays.

"Loans have to be repaid, even loans made at zero percent interest," he said. "They're going to need grants. Especially microbusinesses. Without grants, it means more of the owners' life savings will have to keep going into their businesses when the loans come due.

Bishop says Small Business Services is doing its best to help in a changing landscape.

"We are all operating in a new world," he said. "Owners are applying for one-on-one assistance, but they can't do that face to face. Some businesses don't have the technology to apply remotely. Our partners have switched to helping people do that."

Despite the frustration, he says, business owners shouldn't give up.

"Get your application in," he said. "Even if you're missing documentation, get started. Many banks are helping where they can. Tax returns can be pulled. But the most important message is: get your application in."

Both Bishop and Gjonaj point out that New Yorkers can also play a part in giving the city's small businesses a future after the pandemic ends by remembering the shops and restaurants that stayed open, keeping the city running at the most difficult time.

"It's not only about remembering that those guys were there," Bishop said. "We've always preached shopping local. But look at who's donating food to first responders and hospital workers. They are at a moment where they need every single dollar. In their darkest moment, they’re giving out food. They’re helping their communities."

"Even when they're operating in the red, local restaurants were out there providing food and comfort," Gjonaj said.

Gjonaj suggests supporting them later by dining in their restaurants and picking up your own foods, rather than using third-party apps, which can charge restaurants up to 33% of the price of the meal.

"We know those profit margins will not be there," he says, "and every sale at those rates is yielding a negative loss. And that will make it more difficult for neighborhood restaurants to recover."

And they agree that getting these businesses back on their feet is, at best, complicated. Gjonaj says the city needs to step up and give owners relief from tax payments, which are due in July, and from water and sewer bills. They also need some kind of rent relief, which can't come on the backs of landlords, many of whom are small business owners themselves.

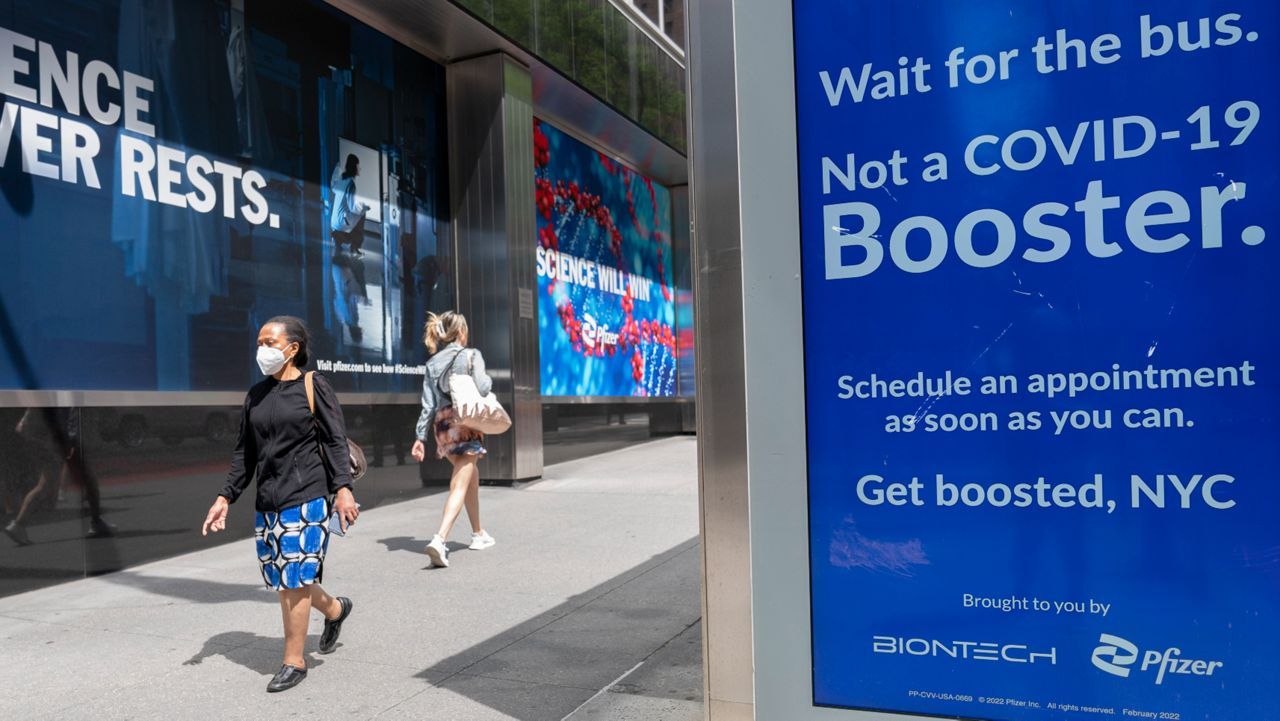

But the real challenge will come when the pandemic ends. How long will it take for consumers to be coaxed into shopping and dining out again?

"That keeps me up at night," Bishop said. "Business owners having confidence they will be prepared for something like this again. Consumers having the confidence to consume again. When will be the right time to say, 'I want to go to a bar, or a restaurant?'"

In the end, the success of the city’s small businesses may come down to all of us.

"If consumers are confident," Bishop said, "I believe a lot of our neighborhood businesses will come back."