This year's state budget won't be agreed upon on time, and a new bill is under consideration that would change how lawyer fees are paid in insurance lawsuits.

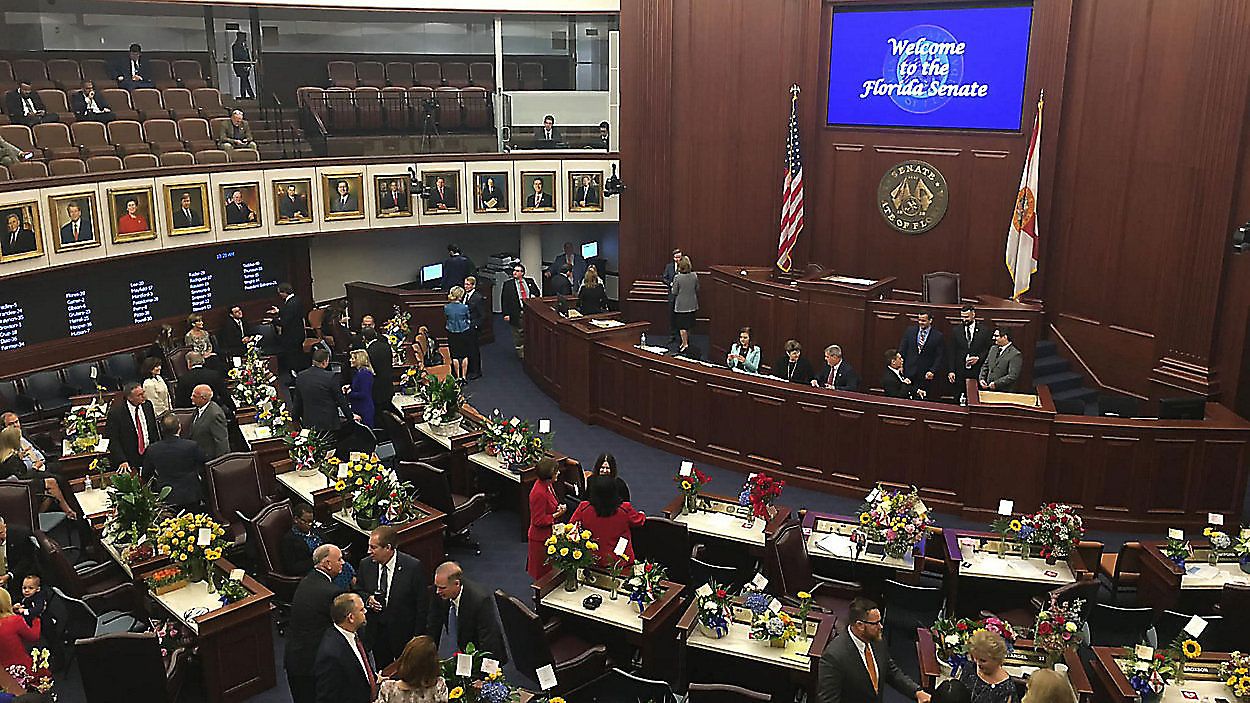

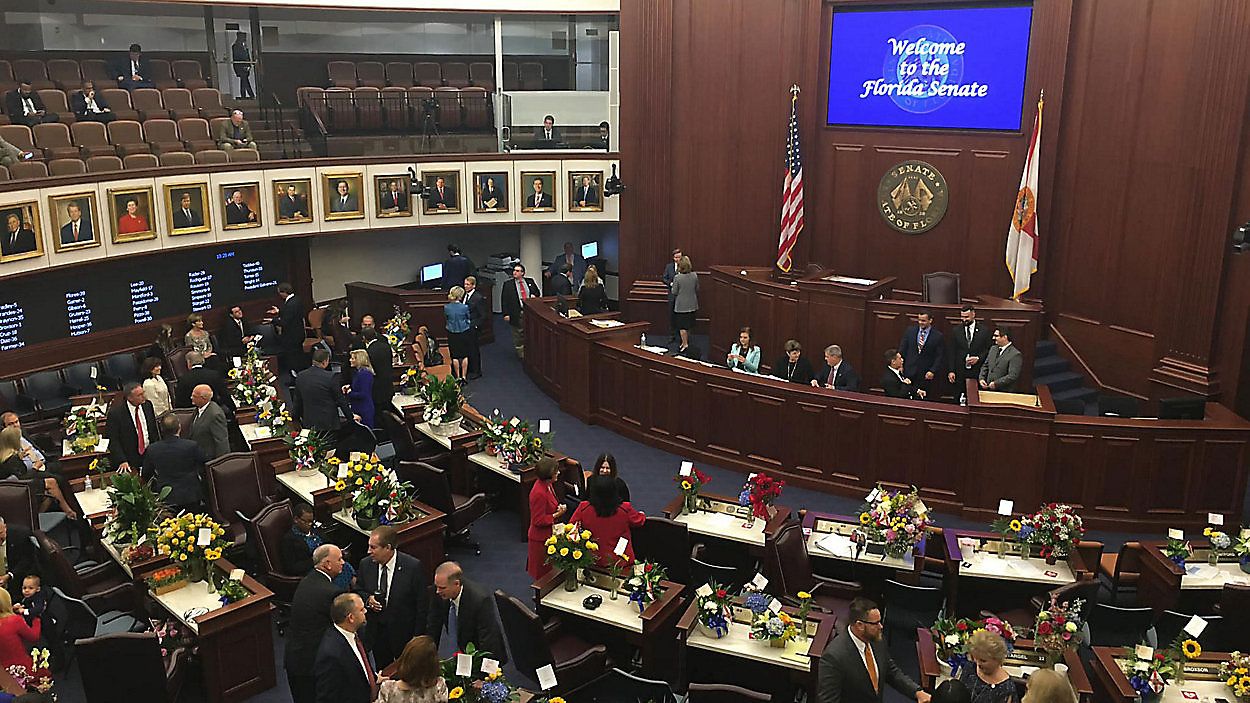

Florida lawmakers grapple with key budget provisions

The 2025 legislative is not going to end on time this year, as lawmakers remain stuck on the Florida budget.

Right now, there’s a $4.4 billion gap in the House and Senate proposals.

Tax relief is the major sticking point in the debate. Lawmakers agree there need to be cuts, but they can’t agree on how to do it. The Florida House wants to permanently cut the sales tax rate from 6% to 5.25%.

Meanwhile, the Senate wants to eliminate sales tax on clothes and items $75 or less. Those in Gov. Ron DeSantis’ camp say they want a $1,000 rebate on property tax.

Democrats say they hope Republicans can find common ground to get it done.

“I’m watching what’s happening with Trump’s tariffs just like everybody else," House Minority Leader Fentrice Driskell said. "The global economy is strong while people are being harmed for building prices. Let’s use the budget as a tool for good, and I hope we can all be grown-ups in the room and work together and get it done.”

It’s not clear whether lawmakers will extend the session or go home for a while and then bring every back.

This is not the first time a state budget hasn’t been passed by the end of the annual 60-day session. Back in 2015, then-House Speaker Steve Crisafulli abruptly adjourned the house with three days still to go in the session.

Senate President Andy Gardiner attempted to broker a deal to keep lawmakers on track, but to no avail. The sticking point of the budget that year was Medicaid expansion. Lawmakers wound up coming back a month later to pass a budget.

New bill could change how lawyers are paid when suing insurance providers

Florida Insurance Commissioner Michael Yaworsky is pushing back against a bill on civil lawsuits.

House Bill 947 aims to reduce or eliminate attorney fees. Specifically, allowing people who sue insurers to get their attorney fees covered by that insurer if they win the case.

But a post from the insurance commissioner’s office says that the bill, “Threatens to dismantle the hard-won progress achieved through Florida’s historic tort reform efforts.”

He’s referring to the tort reform law passed in 2023 that helped limit lawsuits against insurers.

Yaworsky says if passed, HB 947 would create incentives for more lawsuits against insurance companies, which could ultimately lead to higher insurance rates.

Those in favor of the measure feel Florida’s insurance market is already starting to stabilize.

But Yaworsky thinks the bill will undo that progress.

The Senate version of bill was taken up Friday in the House, and State Rep. Tyler Sirois argued that it was a necessity to pass the bill.

“Last year, we passed reforms to stabilize Florida’s insurance market … I voted for that bill," Sirois said. "I was proud to do so. But in doing so, we created some imbalance, and we have to correct that. We have to acknowledge that and we have to correct that.

"We have to make sure that our courts have the ability to make fair decisions. We made it too easy for insurers to delay, deny and underpay claims, making it harder for honest Floridians, whether they’re carrying a hammer or a calculator to fight back."

The vote was 80 to 20 in favor of the bill, with 18 Republicans voting against it. The bill was amended Friday, so now it goes back to the Senate for its approval on the amended version.