Like most workers, Fraank Araneda, a waiter at a Mexican restaurant in New York, welcomes the idea of having less of his income taxed.

What You Need To Know

- Both major presidential candidates — former President Donald Trump and Vice President Kamala Harris — have proposed eliminating federal taxes on gratuities

- Tax policy experts, however, say the proposal would only help a small sliver of Americans and could even backfire in a number of ways

- Only about 2.5% of all workers are in tipped occupations, and among them, 37% earn less than the federal standard deduction, meaning they already do not pay federal income taxes, according to the Yale Budget Lab

- John Ricco of the Yale Budget Lab said the wording of such a bill would be key in determining how it would affect the federal budget and the lives of tipped workers

“It’s sometimes really awful to see what we have in our checks [after tax deductions],” he said.

But Araneda and other workers who are paid tips could soon see some relief. Both major presidential candidates — former President Donald Trump and Vice President Kamala Harris — have proposed eliminating federal taxes on gratuities.

“That would be perfect for us because we can see more money in our checks so we can pay rent, we can get utilities, we can pay our bills, everything,” Araneda said.

Tax policy experts, however, say the proposal would only help a small sliver of Americans – and could even backfire in a number of ways.

The Yale Budget Lab, a nonpartisan policy research group, estimates that roughly 4 million Americans work in tipped occupations, accounting for about 2.5% of all employment. Those workers include waiters, bartenders, delivery drivers and hairdressers.

Tipped workers tend to be younger and have lower incomes than non-tipped workers, economists say. More than a third — 37% — earn less than the federal standard deduction, meaning they already do not pay federal income taxes, according to the Yale Budget Lab.

“The way I would think about it is: it’s a solution in search of a problem,” said Alex Muresianu, senior policy analyst at the Tax Foundation, another policy think tank. “There isn’t a clear reason why one type of income — tips — should be exempt while wages and salaries are not tax exempt.”

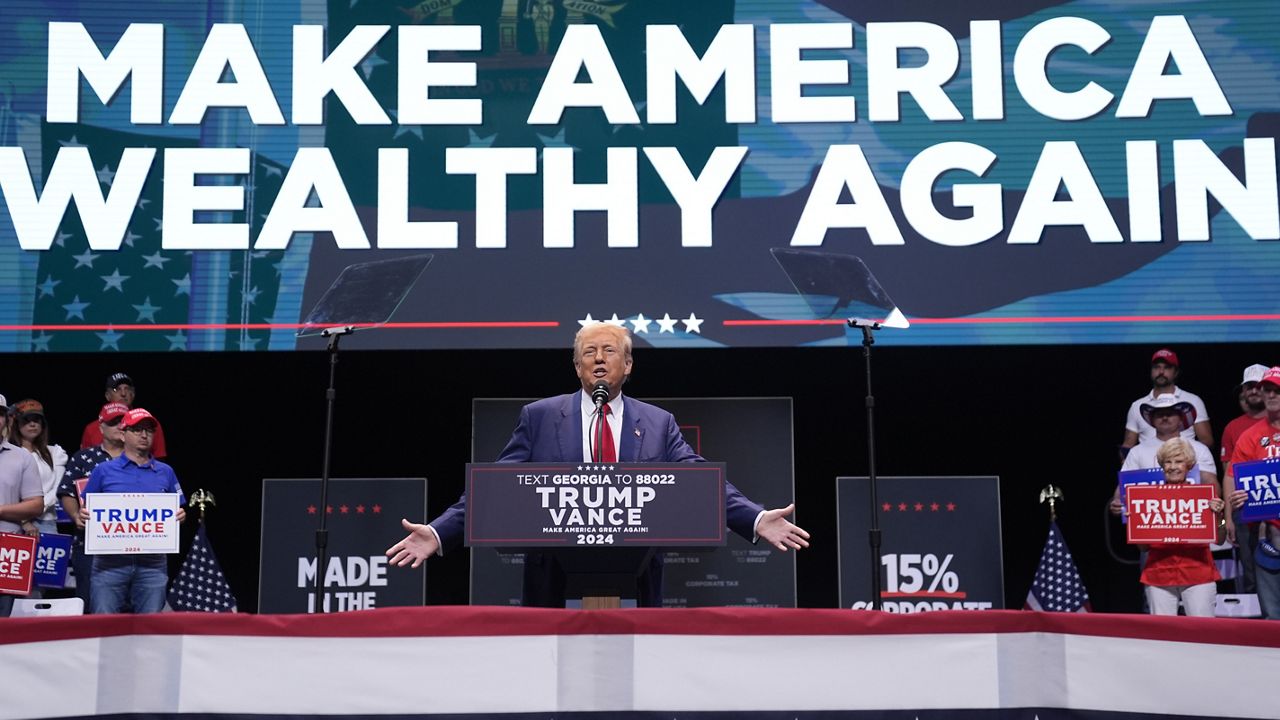

Trump first vowed to eliminate federal taxes on tips at a June campaign rally in Las Vegas, a city with a large contingent of hospitality workers and located in an election battleground state. In August, Harris made a similar promise, also while in Las Vegas, creating a rare issue on which the Republican and Democratic candidates agree.

“For those hotel workers and people that get tips, you’re going to be very happy,” Trump said in his Las Vegas appearance. “Because when I get to office, we are going to not charge taxes on tips.”

The former president has since followed with promises to also eliminate federal taxes on overtime pay and Social Security benefits.

Separately, Harris said during a campaign stop at the University of Nevada at Las Vegas: “When I am president, we will continue our fight for working families of America, including to raise the minimum wage and eliminate taxes on tips for service and hospitality workers.”

Before this summer, the idea was one that received little attention from both lawmakers and economists.

John Ricco, associate director of policy analysis at the Yale Budget Lab, said Republican presidential candidate Ron Paul floated the idea in 2012, but the proposal “never took off until that campaign event,” referring to Trump’s Las Vegas rally.

Since Trump first mentioned his proposal, Republicans have introduced three bills in Congress that would eliminate federal taxes on gratuities.

Anthony Advincula, communications director for Restaurant Opportunities Centers United, a nonprofit group that aims to improve the lives of restaurant workers, called the proposal “superficial” because of how limited its impact would be.

“It’s an effort for political gain rather than focusing on what is needed, what the real solution is,” he said.

Advincula said eliminating the federal subminimum wage — the hourly compensation business owners must pay their employees in addition to their tips — would have a more meaningful impact on restaurant workers. The federal subminimum wage has been $2.13 since 1991, while the regular minimum wage is $7.25.

Both candidates’ proposals have been light on details. Ricco said the wording of such a bill would be key in determining how it would affect the federal budget and the lives of tipped workers.

The Yale Budget Lab estimates that exempting tips from federal income taxes would increase the deficit by at least $100 billion over 10 years. But that number would double if workers also were not required to pay federal payroll taxes on their tips, according to the Yale Budget Lab. The vast majority of payroll taxes fund Social Security and Medicare.

The price tag could go even higher if industries not currently paid gratuities try to benefit.

“Policies that favor one form of income over another in the tax code tend to have issues with tax avoidance or creating loopholes,” Ricco said.

For example, a hedge fund manager could ask his clients to say their compensation was a tip. Muresianu noted that legally tips must be voluntary and cannot be agreed upon in advance, but he added, “It might be very difficult to enforce.”

Tax-free tips could also lead to consumers being hit with new requests for gratuities.

“You don’t typically tip the grocery cashier when they check you out, but, you know, perhaps if there was a tax incentive in play, then grocery stores would introduce the little iPad that flips around to that setting, and then that would increase the budget cost,” Ricco said.

A Pew Research Center poll last year found that 72% of Americans said tipping is expected in more places than it was five years earlier. By a nearly 2-to-1 margin, the public is more negative than positive about all the automated tip suggestions.

Spectrum News requested interviews from both the Trump and Harris campaigns for this article. The Harris campaign did not respond. The Trump campaign provided a statement and fact sheet, but neither offered details about his proposal.

“President Trump’s No Tax on Tips policy will keep money in the pockets of our great hospitality workers who’ve been greatly hurt by Kamala Harris’ disastrous economic policies that created a once-in-a-generation inflation crisis with runaway inflation and stagnant wages,” Trump campaign national press secretary Karoline Leavitt said in a statement.

Leavitt accused Harris of plagiarizing Trump’s plan “because she knows it’s popular.”

Harris has previously said workers would still owe payroll taxes under her plan. And her campaign told The Washington Post the vice president’s proposal would take steps to prevent abuse by limiting tax exemptions on tips to certain industries and below a stated income threshold.

While tipped workers would pocket more of their pay in the short-term under either candidate’s proposal, it could come at a price in other ways.

For example, if they are not required to pay into Social Security, it could mean reduced retirement benefits. And those who receive tax credits that provide support to low- and moderate-income working parents — such as the Earned Income Tax Credit and Child Tax Credit — could end up worse off if they are claiming less income.

But Ricco noted a bill could be structured so that workers can both avoid paying taxes on tips and receive such tax credits.

Another theory floated by some economists is that such a move would create greater demand for jobs in industries with tips, leading to business owners offering lowering hourly wages.

With both candidates behind the idea, it alone is unlikely to win over voters. But Araneda said that might still have been the case even if just one candidate had made the promise.

“Both candidates are going to propose, like, ‘We are going to cut taxes on your payment checks’ or whatever, but then when they are in the power, when they are in the government, they don’t do anything about workers. It’s just about companies.”

Ryan Chatelain - Digital Media Producer

Ryan Chatelain is a national news digital content producer for Spectrum News and is based in New York City. He has previously covered both news and sports for WFAN Sports Radio, CBS New York, Newsday, amNewYork and The Courier in his home state of Louisiana.