Last year, 31-year-old Briana Goldman and her fiance Marc got engaged. It was an exciting moment in a difficult time.

“I was diagnosed with Hodgkin's lymphoma last August. We got engaged literally two weeks after my first treatment,” Goldman said.

Now, after seven months of fighting, Goldman is in remission. She is ready to buy a house where she grew up.

“I am just a very loyal Brooklynite,” Goldman said.

But staying in her home borough could be difficult. For the last 20 years, she has lived in a New Utrecht rental with her mother. As Goldman, her mom and her fiance try to buy a home in Brooklyn, her dream comes with a high price.

“So anything that you look for around here is not going to be under [$1.5 million]. We're really looking to stay more like a million,” Goldman said.

Goldman says that even with that budget and the help of a realtor, finding a home in Brooklyn is hard.

“You go to a house and I don't know if it's true or not, if they're trying to get you to buy, but they'll say ‘someone bid over the asking price.’ Well, that's great for them. I don't have over the asking price,” Goldman said.

Jonathan Miller is the president and CEO of Miller Samuel Inc., a real estate appraisal and consulting firm. Miller says that after COVID-19 lockdowns ended, mortgage rates were too low for too long and too many people bought homes.

“An insatiable demand for housing was created not just in the city, but in the U.S., where we had one of the biggest housing booms in the modern era. As a result, that burned off a lot of excess inventory. That has caused prices to rise and create more bidding wars,” Miller said.

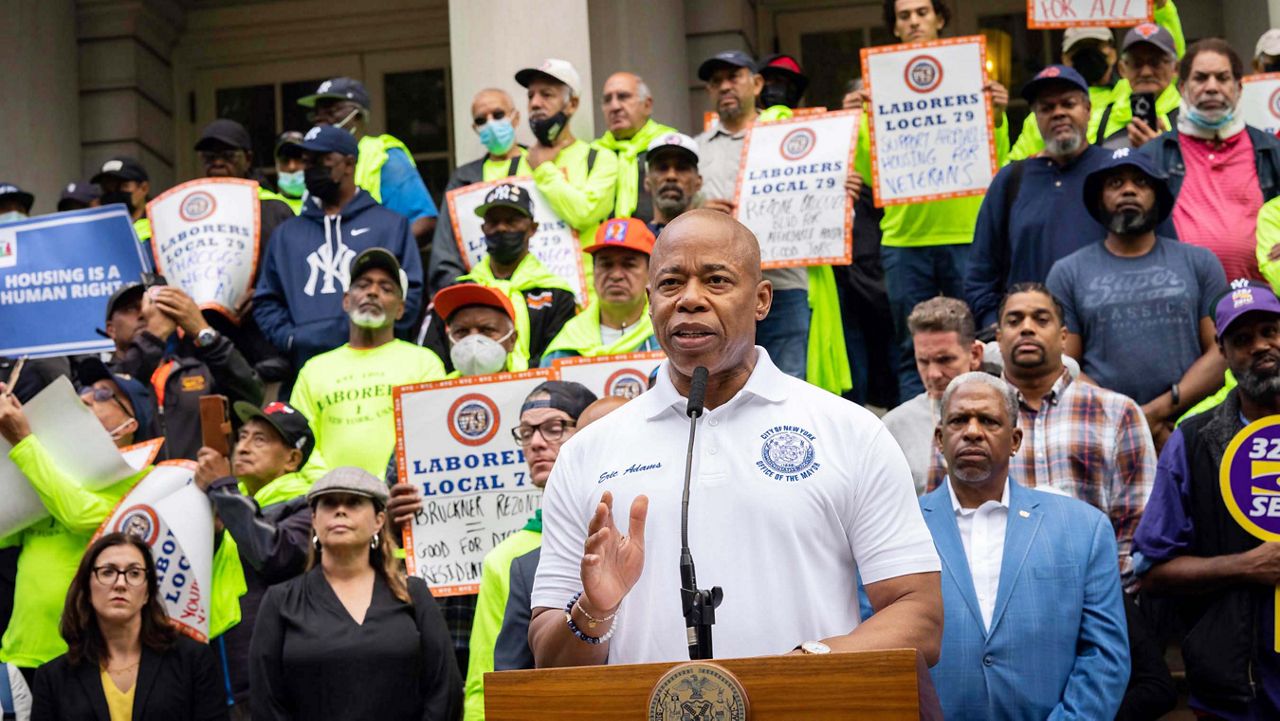

Low inventory is nothing new for the five boroughs. The city has struggled with creating affordable housing for the average person. Now that mortgage rates are quickly rising, potential buyers feel they need to act quickly, creating an even smaller pool of real estate.

Last October, when Goldman got engaged, mortgage rates were around 3.7%. Now, they’re about 7%. That means the additional monthly interest for a home in Goldman’s price range is about $2,100 more a month than it was last year — all in interest.

“Even if [I have] been working since I was 18, how much money do you think a young couple has?” Goldman said.

Although the market looks grim, Miller says patience is a virtue. Since interest rates increased this year, early reports have shown the market has slowed down — a sign that inventory may increase and interest rates may eventually go back down.

Goldman says regardless, she is a fighter and not one to give up on a dream.

“I feel like everyone leaves because they feel like they get kicked out. And I'm not a person that settles, so I refuse to get kicked out. So I'm going to make it work, however it works,” Goldman said.