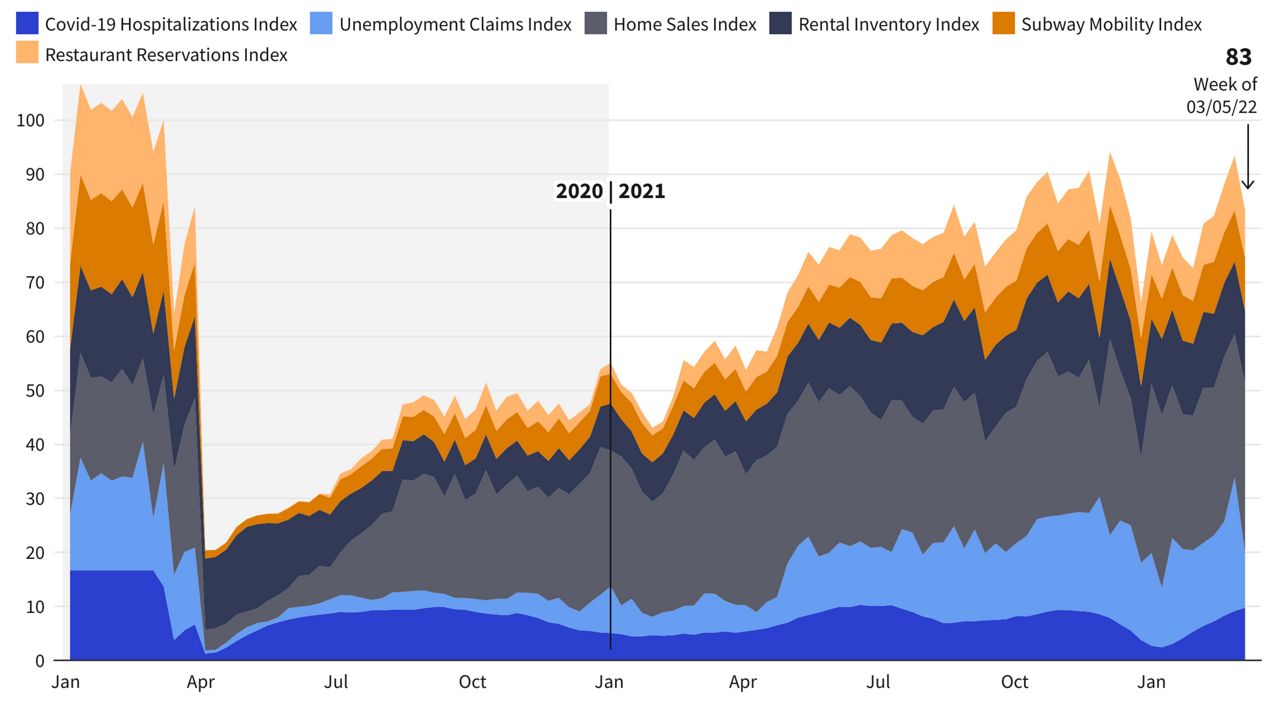

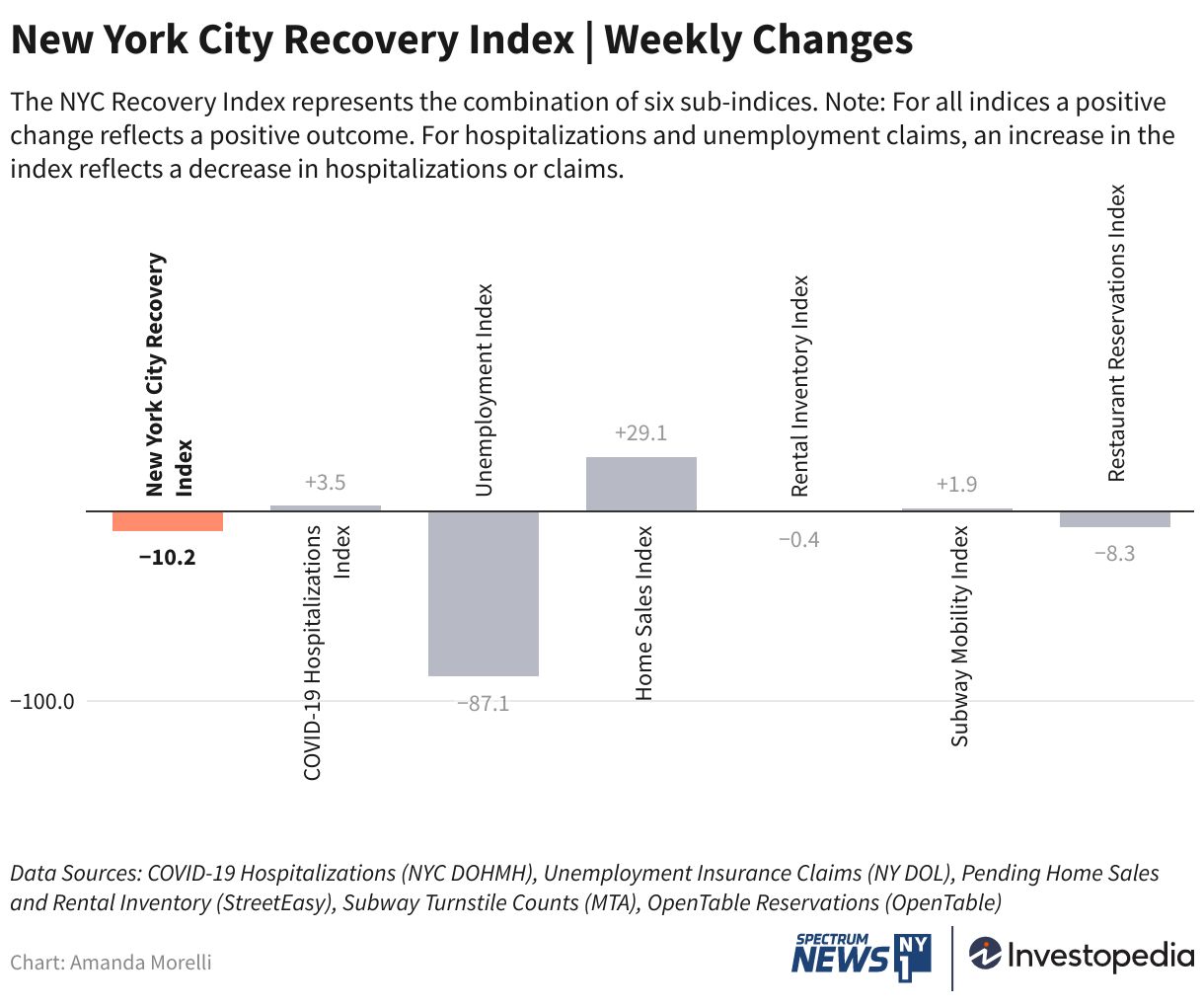

New York City’s economic recovery index experienced some setbacks for the week ended March 5, dropping the overall index score from 93 to 83. A jump in unemployment claims and a decrease in restaurant reservations contributed to the big week-over-week decline. However, COVID-19 hospitalizations continue to fall, subway ridership keeps climbing, and the home sales market is back to running well above 2019 levels.

On Sunday, New York State reported less than 1,000 positive cases of COVID-19—the lowest number of daily cases seen since July 18th, 2021. "As we mark two years since the first confirmed death from COVID-19 in New York State, it's meaningful to see how effective our fight against the virus has been," New York Governor Hochul said in a statement on Monday. “Millions of New Yorkers have been vaccinated and boosted, and I encourage everyone to talk to their doctor and schedule a vaccine for yourself and your family,” she added.

New York City’s recovery stands at a score of 83 out of 100, according to the New York City Recovery Index, a joint project between Investopedia and NY1. Nearly two years into the pandemic, NYC’s economic recovery is over fourth-fifths of the way back to early March 2020 levels.

COVID-19 Hospitalizations Keep Falling

COVID-19 hospitalization rates continued to decline for the week ended March 5, with the trailing seven-day average now at 27 hospitalizations per day, which is 9 fewer than last week. COVID-19 hospitalizations have been on the decline for eight straight weeks. If they continue to drop, COVID-19 hospitalizations could reach their lowest levels since the start of the pandemic.

Of the declining COVID-19 cases in the area, the CDC continues to project 100% of new cases in the New York region (along with New Jersey, New York, Puerto Rico, and the U.S. Virgin Islands) are related to omicron. A total of 2,288,534 cases and 39,964 deaths were recorded in New York City as of March 16, while 77.3% of New York State’s population has been fully vaccinated against COVID-19, according to NYC Health data.

Unemployment Claims Increase

Unemployment claims increased from 5,320 to 12,830 for the week of March 5, while the rolling average of claims over the same period in 2019 decreased from 7,883 to 7,833. This pushed the index score down to 61, the lowest score since July 2021. While the increase puts city-wide UI claims at 63% above 2019 levels, the City’s unemployment levels historically spike around the first week of March before stabilizing. However, if UI claims don’t decrease in the coming weeks, it could be a sign of growing instability in the city’s labor market.

The rise in UI claims for the week ended March 5 impacted the proportion of claims from each borough as a percent of the total. Brooklyn’s share of the total UI claims for March 5 was 27% instead of the average 22%, while Staten Island’s claims made up 9% instead of an average of 6%. Conversely, Manhattan’s claims were only 12% of the total as opposed to their normal range of 17 to 18%. This shows how the spike in unemployment claims impacted Brooklyn and Staten Island much more than Manhattan.

Home Sales Rise

Pending home sales had a notable increase the week of March 5, bumping the home sales index up from 159 to 188. Home sales increased from 589 to 710 for the week ended March 5, compared to a smaller increase in the 2019 rolling average from 371 to 378 over the same weeks, which pushed the index score up. Despite last week’s setback, pending home sales have rebounded well, and are currently at about 88% above pre-pandemic levels, one of the highest rates in the index’s history. By borough, Brooklyn leads the increases with a 116% increase in home sales compared to 2019 levels, with Manhattan and Queens following behind at 86% and 55%, respectively.

Rental Market Little Changed

There were 13,451 rentals on the market in New York City for the week of March 5, almost 1,000 more than last week. Despite the increase, the rental index score remains effectively unchanged from the previous week, at around 80. While this is an expected seasonal increase in vacancies, the market still needs hundreds of vacancies to fully recover to pre-pandemic levels.

Subway Ridership Continues to Climb

Subway ridership posted another week of positive gains the week of March 5, as the seven-day trailing average of riders is now 41% below 2019 levels, down from 43% below last week. The increase this week is slightly larger than that of the week before, bringing subway ridership numbers closer to clearing the threshold of 40% below pre-pandemic levels. As of March 5, the MTA reported a trailing seven-day average of 2.70 million riders.

Restaurant Reservations Dip

Restaurant reservations in New York City reversed course for the week ended March 5, decreasing from 39% below 2019 levels last week, to 47.5% below 2019 levels this week. Though the setback wiped out gains seen the past two weeks, restaurants could experience seasonal increases as warmer weather comes over the next few months, similar to those seen in spring and summer oIPTION page:

To get more news and information from this partner, subscribe here.