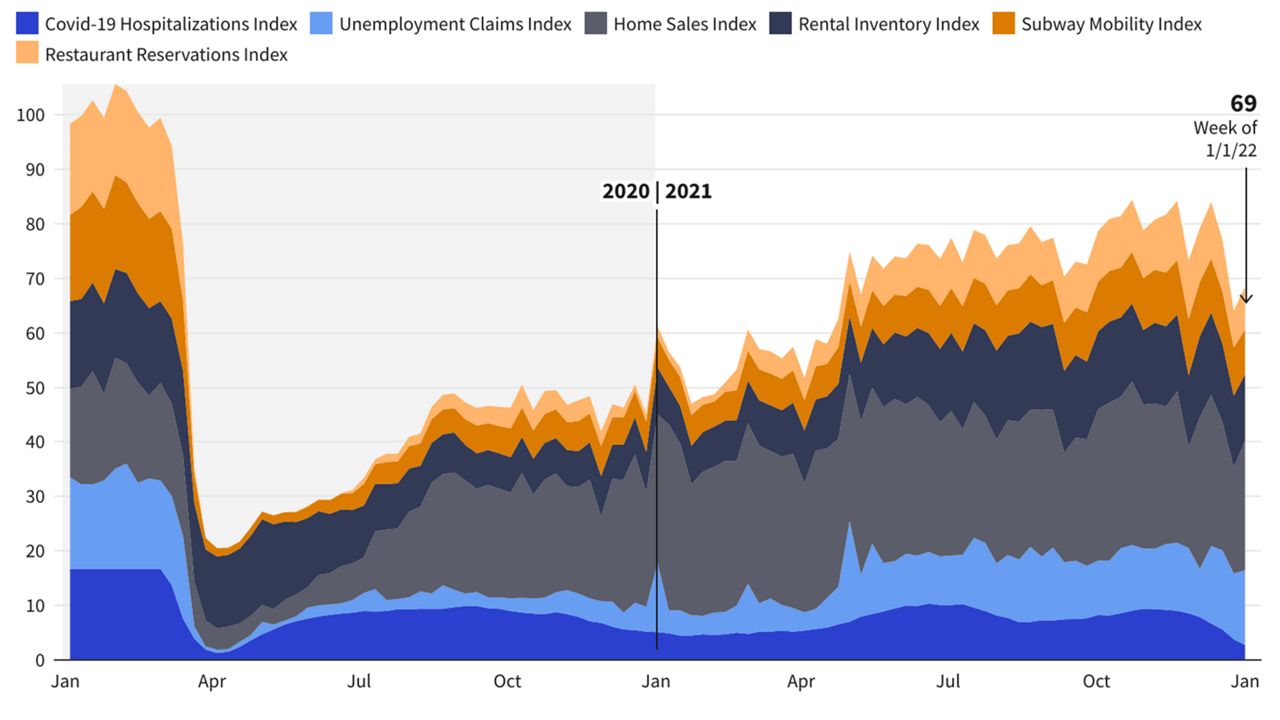

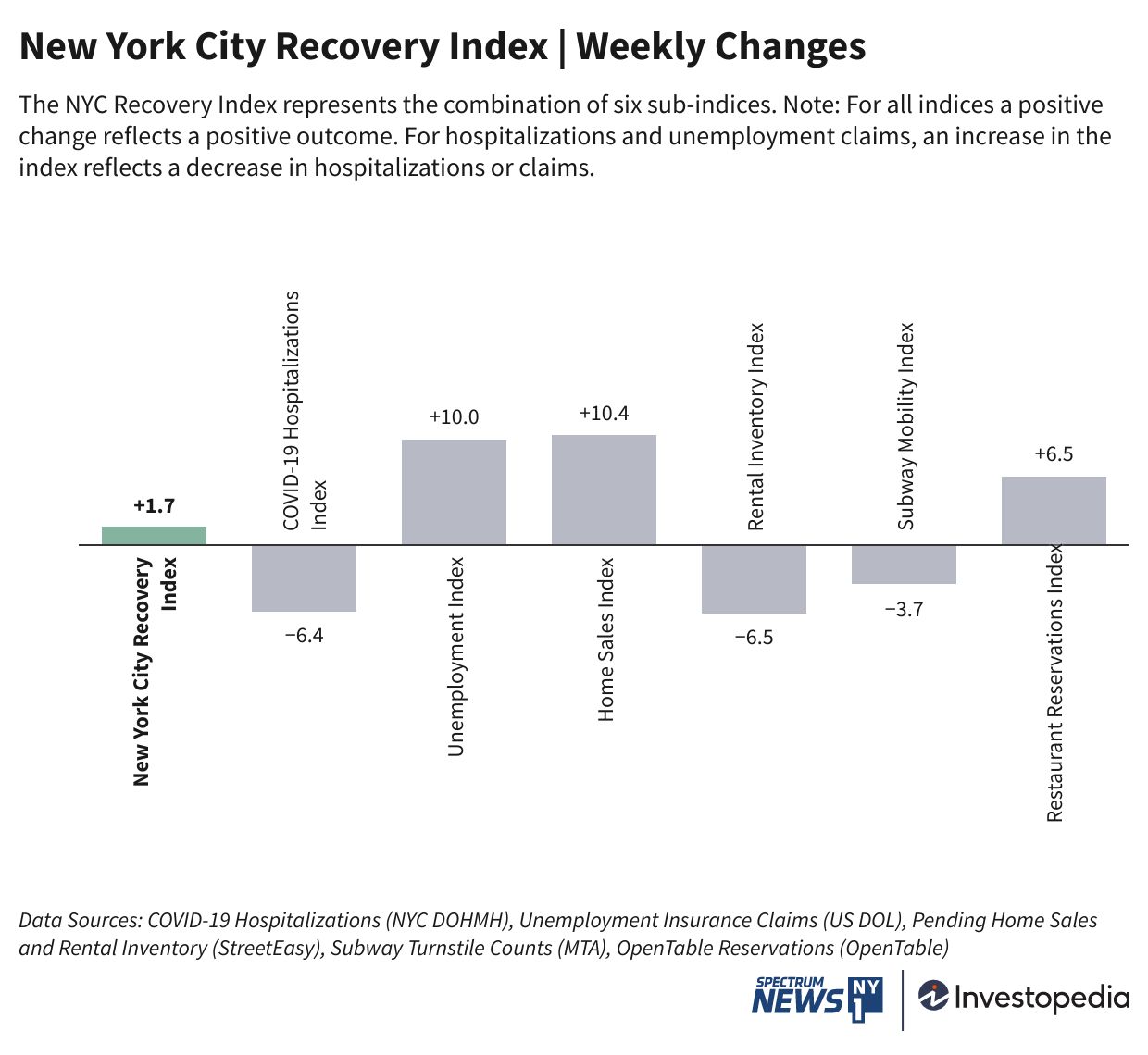

New York City’s economic recovery index made slight progress over the week ended Jan. 1, as the index rose to a score of 69. Pending home sales accounted for the greatest gain, and remains the best-performing in the index, with sales above pre-pandemic levels. Restaurant reservations also got a boost, though most other measures experienced setbacks, as subway ridership dipped and COVID-19 hospitalizations continued to climb.

This week, students in New York City public schools planned a walkout to protest the city’s COVID-19 policies keeping schools open and the absence of remote learning options, after city officials announced the “Stay Safe and Stay Open'' plan for schools. The plan doubles in-school testing and other measures aimed at reducing student absences. Last week, New York Governor Kathy Hochul said the state would raise funding for New York schools, with an emphasis on recruiting new staff to address a shortage of teachers.

New York City’s recovery stands at a score of 69 out of 100, according to the New York City Recovery Index, a joint project between Investopedia and NY1. Over a year and a half into the pandemic, NYC’s economic recovery is just over two-thirds of the way back to early March 2020 levels.

COVID-19 Hospitalizations Surge

COVID-19 hospitalization rates continued to rise as of Jan. 1, climbing to a seven-day average of 836 hospitalizations per 100,000 people. That rate surpasses the second wave in January of last year, hitting highs not seen since April of 2020.

The omicron variant of COVID-19 has overtaken delta, with the CDC projecting that roughly 98% of new cases in the New York region (along with New Jersey, Puerto Rico, and the U.S. Virgin Islands) are linked to omicron.

A total of 1,977,780 cases and 36,089 deaths were recorded in New York City as of Jan. 11. As of Jan. 10, 74% of New York State’s population has fully vaccinated against COVID-19, per the CDC.

Unemployment Claims Ease

After a sudden surge last week, unemployment claims dropped back to an estimated 22% above pre-pandemic levels as of Jan. 1, not far from their pandemic best of 15%, reached just a few weeks prior. With the unemployment index at a score of 82, and several weeks at the end of 2021 hitting above 80, the measure could be close to a recovery heading into the new year.

Home Sales Bounce Back

There were 388 pending home sales in New York City as of Jan. 1, raising the city’s overall score. Home sales continue to surpass 2019 levels, with sales running 43% higher than 2019 rates over the same period. By borough, sales in Manhattan are up 37% compared to pre-pandemic levels, while sales figures in Brooklyn are up 43%, and sales in Queens are up 26%.

Rental Market Squeezed

New York City had 11,378 rentals on the market for the week of Jan. 1, a decline of over 500 fewer units than the week prior, pulling the rental index down to a score of 73. Rental inventory is typically low during the winter months, as vacancies are increasingly scarce, and are now at roughly 20% below 2019 levels. Renters looking to move in late winter could begin to feel a squeeze in the new year.

Subway Ridership Continues Slump

Subway ridership had another setback during the first week of 2022, as the seven-day trailing average of riders is now 51% below 2019 levels. This is the fifth week of declines in ridership, down nearly 290,000 riders from the previous week, and eliminating a bump in ridership seen in November. The MTA now estimates a trailing 7-day average of 1.87 million riders as of the first of the year.

Beyond the subway, other forms of transit are also down below pre-pandemic levels. Comparing seven-day averages for the week ending Jan. 1 reveals that Metro North and LIRR were hit the worst, at 62% and 61% below pre-pandemic levels, respectively. Bus ridership was down 43%, while Access-A-Ride ridership was 36% lower than pre-pandemic levels. Meanwhile, bridges and tunnels are closest to 2019 levels, down just 13% from pre-pandemic usage.

Restaurant Reservations Increase

Restaurant reservations saw a significant increase for the first week of the new year, though still at least 53% below 2019 levels. This week’s gain interrupted a two-week streak of losses, including a significant drop for the previous week. However, as the weather starts to dip into the lowest temperatures of the year, and with Omicron on the rise, reservations may be slow to pick up.