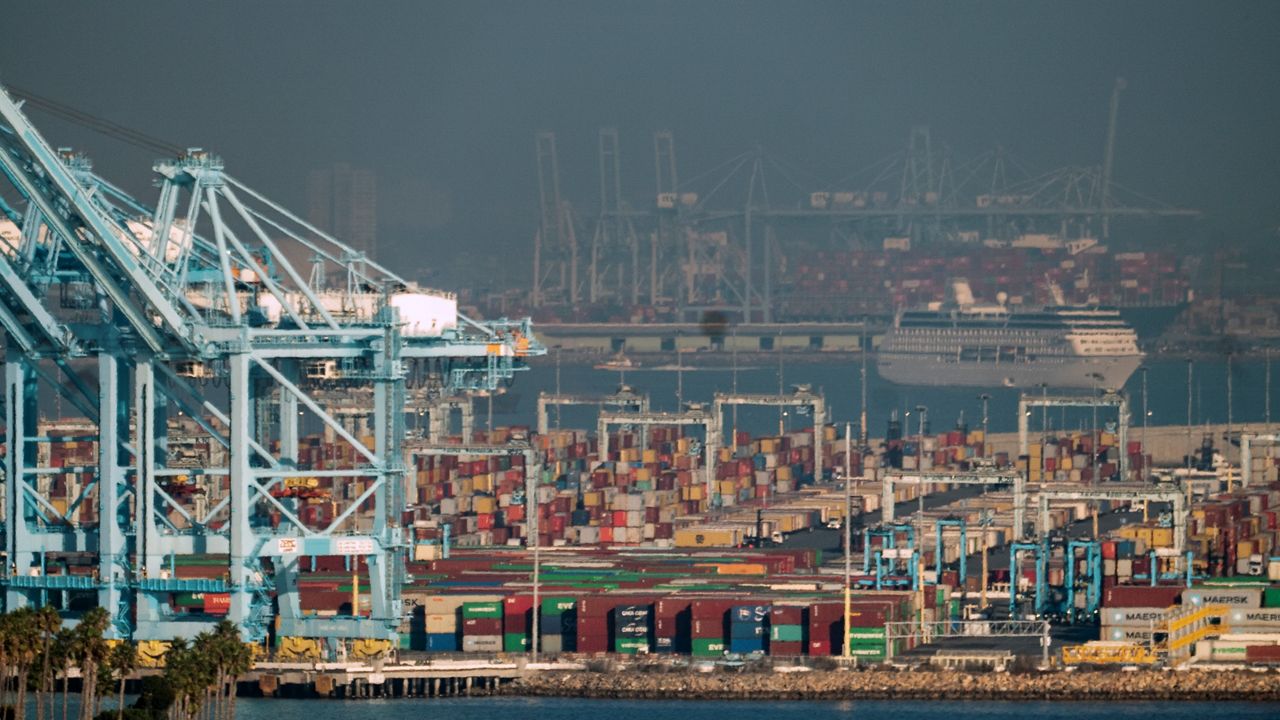

LOS ANGELES — Two months into 2025, the Port of Los Angeles moved 1.7 million container units, marking a 5.4% percent increase over the same period last year, officials announced Wednesday.

In February, cargo volume remained strong with a total of 801,395 twenty-foot equivalent units, an increase of 2.5% over the same month last year. It also marked the second-busiest February on record, according to port officials.

"Many retailers and manufacturers have been importing their products through Los Angeles earlier than usual as a hedge against tariffs," Port of LA Executive Director Gene Seroka said during an online media briefing. "Given the substantial inventory already here, and the uncertainty of tariffs, it's possible we could see a 10% volume decline in the second half of the year."

"Here in Los Angeles, we will continue to look for new opportunities to bring more business through our gateway," he added.

Imports came in at 413,236 TEUs, a 1% increase, while loaded exports came in at 109,156 TEUs, representing an 18% decrease, compared to February 2024. The port also processed 279,006 empty containers, a 16% increase.

"For 17 of the last 19 months, the Port of Los Angeles has experienced year-over-year cargo growth, all without ship delays or back-ups on our docks. That's a testament to the outstanding work of the women and men of the International Longshore and Warehouse Union, our terminal operators, truckers, railroads and other stakeholders," Seroka said.

Nela Richardson, chief economist for the ADP Research Institute, joined Seroka to discuss the impacts of tariffs. ADP provides payroll services for 40 million workers, globally and domestically — that's one in six workers in the private sector.

She explained that the role of tariffs is essentially a tax on imported goods, and historically, there have been reasons that countries would want to apply them.

"It's to protect nascent industries, for innovation or to protect work forces," Richardson said. "It's also really important to understand how the tariff is rolled out and the motivation behind it."

The U.S. has a trillion dollar trade deficit, which has been running since the 1970s. In part, economists say that's because the U.S. has consumers who are wealthier than the rest of the world, on average.

"It may not feel like that, especially if you bought eggs in the last two weeks," Richardson added.

She described as the global landscape — the consumer base — as "solid" and "strong."

"...The wealth of the U.S. is one of the reasons driving the trade deficit, with the current policy there is a sense that we're continuing a rebalancing effort that I think started at the pandemic time. Companies realized the vulnerability of the supply chain," Richardson said.

While there may seem like there's a hiring slowdown, there's no sense of uncertainty in manufacturing. Recent data showed manufacturers hired more workers in the last two years, according to Richardson.

"What we're seeing in our most recent data, layoffs are at historically lows," Richardson added. "...Also in other indicators, the labor market is extremely stable right now."