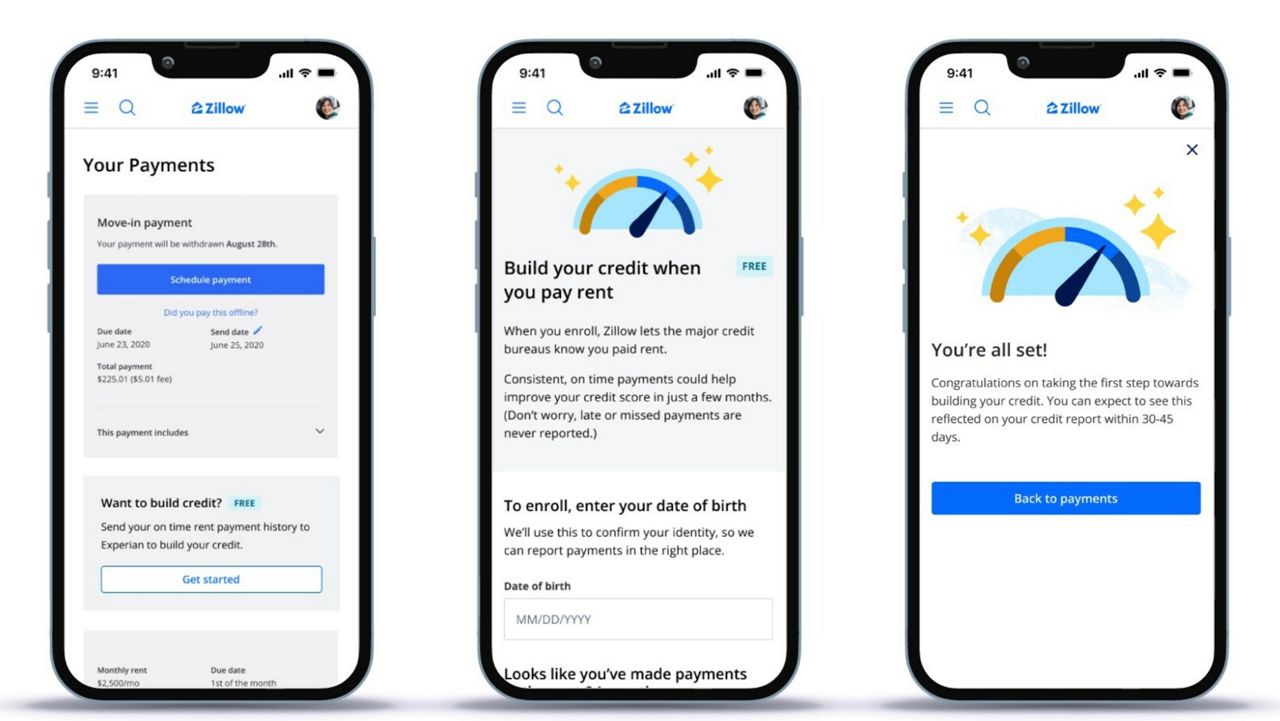

The real estate company Zillow launched a new rent payment reporting tool for tenants to build credit.

Renters who make on-time payments through Zillow can opt into reporting them to a national credit bureau.

“Every on-time rent payment is a testament to a renter’s reliability, yet it’s often overlooked in credit reports, and we want to change that,” Zillow Rentals vice president Michael Sherman said in a statement.

According to the Consumer Financial Protection Bureau, an estimated 26 million Americans lack history with the major credit reporting bureaus, making them less able to secure loans and credit cards.

Last November, Zillow released a report which found that Black families who can afford to buy homes are often trapped in more expensive rentals because they lack access to credit. The report found that monthly mortgage payments for many families would be lower than rent, even with mortgage rates at 22-year highs.

Credit inaccessibility is a legacy of now-illegal redlining practices dating back to the 1930s, when lenders first began using color-coded government maps to determine the loan worthiness of certain neighborhoods and denied loans to those they found too risky.

The Zillow report found that a median renter in a credit-insecure area of New Orleans spends 77.5% of their income on rent compared with 28.6% for an average mortgage.

Access to safe ways of credit building are limited in Black neighborhoods, the report found, and rent payments often do not help build credit. Improving credit access is one way of closing the racial wealth gap.

Available for free to renters who already use Zillow for their monthly payments, the new rental payment reporting system is “all about acknowledging and supporting consistent financial habits,” Sherman said. “It ensures renters’ largest expense can now work in their favor and potentially help them on their path to finding and securing a place they can call home.”

Renters who make their payments within 30 days of the due date will have them reported monthly to Experian. Late payments are not reported. Those who use the reporting tool can opt out at any time.