A group of New York lawmakers from outside the city aren’t happy with a piece of Gov. Kathy Hochul’s proposed $1.3 billion bailout plan for the MTA.

The governor is seeking $800 million annually by hiking the payroll mobility tax. The lawmakers believe their constituents shouldn't have to foot the bill.

A letter they sent to Senate Majority Leader Andrea Stewart Cousins says in part: “Exempting non-New York City from the increase associated with the already unjust tax is the appropriate response.”

What You Need To Know

- A group of New York state lawmakers from outside the city have penned a letter to the Senate majority leader urging against a proposed tax increase

- The governor is seeking $800 million annually by hiking the payroll mobility tax. The lawmakers believe their constituents shouldn't have to foot the bill

- An increase in the payroll mobility tax would impact certain employers and those self-employed engaging in business within what’s known as the “Metropolitan Commuter Transportation District"

The group argues this is a burdensome tax, and their constituents don’t use the subways as frequently as city commuters do, so they shouldn’t have the additional burden.

But some riders in the city say it’s not fair that the tax is passed along to them, either.

The MTA does have planned fare hikes to help pull it out of a budget hole caused by low ridership. The MTA plans to raise fares by 5.5% by the end of the year.

Several riders, like Brooklyn resident Alan Prescott, say one way to raise money is to end fare evasion.

“Every day I see tons and tons of people entering the subway without paying," Prescott said. "And people like me who work hard, who pay their fare honestly, see that. And we don’t have the impetus to pay our fare either."

The MTA said it loses $500 million a year to fare evaders.

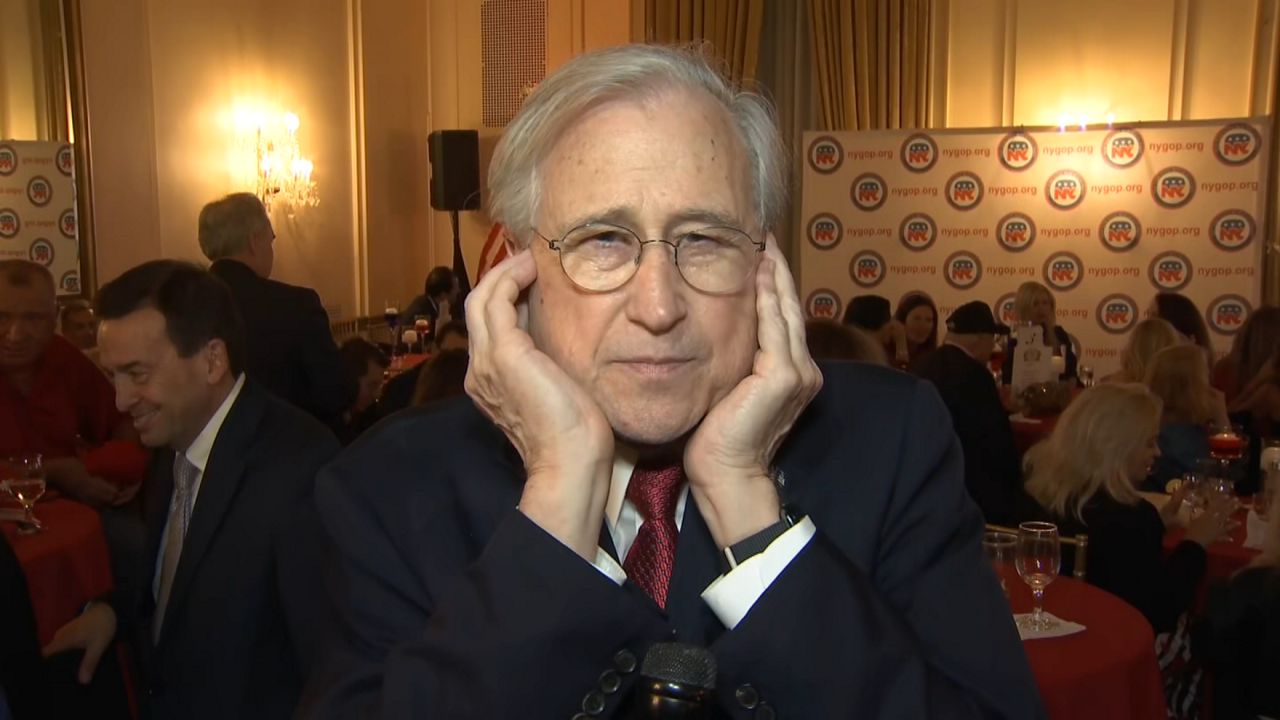

State Sen. James Skoufis said bailing out the MTA is like Groundhog Day.

“We had a COVID bailout to the MTA. We had congestion pricing that was supposed to bail out the MTA. And now we have another bailout to the MTA,” Skoufis said.

An increase in the payroll mobility tax would impact certain employers and those self-employed engaging in business within what’s known as the "Metropolitan Commuter Transportation District." That district includes the city and seven counties outside of the five boroughs, including Rockland, Nassau and Westchester counties.

“If we're going to bail out the MTA again, there should be some match within the MTA to find savings," Skoufis said.

Hochul defends the tax plan as a relatively small amount of money needed to boost the MTA, as state officials seek to also increase ridership.